Whether you’re launching a new venture or scaling an existing business, your business credit score plays a vital role in securing funding, building partnerships, and managing risk. Yet, many entrepreneurs are unfamiliar with how business credit scores work, how they’re calculated, and why they matter.

In this comprehensive guide, we’ll break down everything you need to know about business credit scores and how to improve them.

What Is a Business Credit Score?

A business credit score is a numerical representation of your company’s creditworthiness. It indicates how likely your business is to repay debts and fulfill financial obligations. Just like personal credit scores help lenders assess individual borrowers, business credit scores help banks, suppliers, and investors evaluate businesses.

Why Business Credit Scores Matter

Here’s why a strong business credit score is important:

- ✅ Loan & Credit Approval: Lenders use it to decide if they’ll offer you financing and at what interest rate.

- ✅ Better Supplier Terms: Suppliers may offer more favorable terms if you have a solid credit history.

- ✅ Lower Insurance Premiums: Insurers often use credit data when calculating premiums.

- ✅ Business Partnerships: Other companies may check your score before entering into contracts or partnerships.

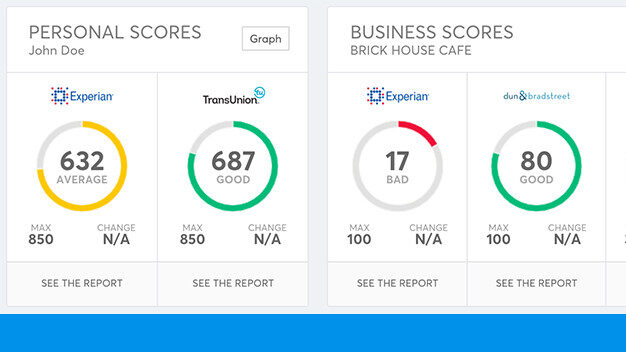

Personal vs. Business Credit: Key Differences

| Factor | Personal Credit | Business Credit |

|---|---|---|

| Based On | Individual SSN | Business EIN |

| Reporting Agencies | Experian, Equifax, TransUnion | Dun & Bradstreet, Experian Business, Equifax Business |

| Score Range | 300–850 | 0–100 (varies by agency) |

| Tied To Business? | No | Yes |

Major Business Credit Reporting Agencies

There are three main credit reporting bureaus for businesses:

- Dun & Bradstreet (D&B) – Provides the popular PAYDEX score (0–100 scale).

- Experian Business – Offers a business credit score from 0 to 100.

- Equifax Small Business – Uses multiple scoring models, including payment index and failure risk.

How Business Credit Scores Are Calculated

Each bureau has its own method, but they usually consider:

- 📅 Payment History – Paying bills on time is crucial.

- 💳 Credit Utilization – How much of your available credit you’re using.

- 🏢 Company Size and Age – Older, more established businesses may get better scores.

- 📂 Public Records – Bankruptcies, liens, and judgments can negatively impact your score.

- 🔍 Credit Inquiries – Frequent credit applications may lower your score.

How to Check Your Business Credit Score

You can access your business credit report and score through:

Some services charge a fee, while others offer limited free access.

How to Improve Your Business Credit Score

- Incorporate Your Business: Form an LLC or corporation to separate personal and business credit.

- Get an EIN: An Employer Identification Number is essential for building business credit.

- Open a Business Bank Account: Keep personal and business finances separate.

- Establish Credit Accounts: Open trade lines with suppliers who report to credit bureaus.

- Pay On Time (or Early): Payment history is the most important factor.

- Monitor Your Reports: Check for errors and dispute incorrect information.

- Limit Credit Usage: Keep credit utilization below 30% if possible.

- Avoid Frequent Applications: Apply for new credit only when necessary.

Common Myths About Business Credit

🚫 Myth 1: Personal credit doesn’t affect business credit.

If your business is new or unestablished, lenders may rely heavily on your personal credit.

🚫 Myth 2: All vendors report to credit bureaus.

Many don’t. Always ask suppliers if they report before doing business.

🚫 Myth 3: You automatically get a business credit score.

You must take steps (like getting an EIN and credit accounts) to build your score.

Final Thoughts

A good business credit score is more than just a number—it’s a key tool for growth. By understanding how business credit works and actively managing it, you can secure funding, negotiate better deals, and protect your company’s financial future.

Start today by checking your score, paying bills on time, and being proactive about your credit profile.