Traditionally, investing in real estate meant having large sums of capital, dealing with agents, and managing properties directly. But the investment world has changed. Enter real estate crowdfunding — a modern, tech-driven approach that’s making property investment accessible to the everyday investor.

Whether you’re new to real estate or looking to diversify your portfolio, this blog will break down what real estate crowdfunding is, how it works, and why it might be your next big investment opportunity.

What Is Real Estate Crowdfunding?

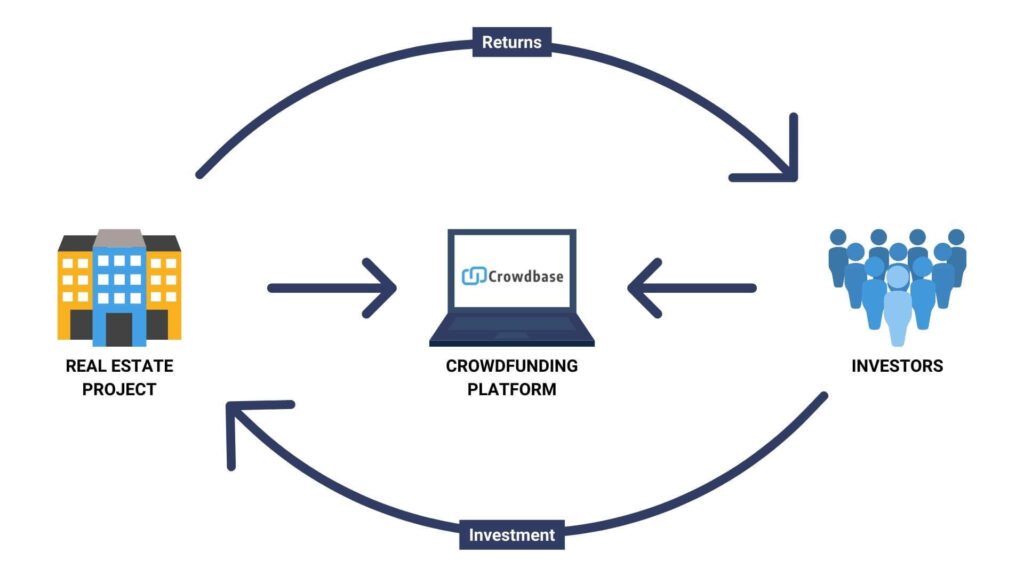

Real estate crowdfunding is a method of pooling funds from multiple investors to finance real estate projects — such as rental properties, commercial buildings, or real estate development. It’s typically done through online platforms that connect investors with vetted property deals.

Instead of buying an entire property, you can invest as little as $500 or $1,000 and own a fraction of the asset, sharing in the potential profits and income.

How It Works

Here’s a basic breakdown of the process:

- A real estate project is listed on a crowdfunding platform (e.g., Fundrise, RealtyMogul, CrowdStreet).

- Investors review details like location, strategy, returns, and risk.

- Interested investors commit funds to the project.

- Once funded, the project is developed or managed.

- Investors receive returns through rental income, interest payments, or profit from property appreciation.

Benefits of Real Estate Crowdfunding

✅ 1. Lower Barrier to Entry

Traditional real estate often requires tens or hundreds of thousands of dollars. Crowdfunding lets you get started with minimal capital.

✅ 2. Diversification

Spread your investments across different properties, locations, or asset types — reducing risk and increasing potential reward.

✅ 3. Passive Income

Many crowdfunding deals generate ongoing income through rents or interest, with minimal effort from your side.

✅ 4. Access to Commercial Deals

Platforms often list high-value properties like office buildings or apartment complexes — investments previously limited to institutional investors.

✅ 5. Technology & Transparency

Online dashboards make it easy to track performance, view documents, and manage your portfolio with full visibility.

Risks to Consider

Like any investment, real estate crowdfunding comes with risks:

- Illiquidity: You may not be able to sell your share quickly.

- Market risk: Property values can go down, reducing returns.

- Platform risk: Not all platforms are equal — research their track record and regulation status.

- Project failure: If a project doesn’t go as planned, returns may be lower or delayed.

Always read the fine print, and consider only investing money you’re prepared to tie up for several years.

Popular Real Estate Crowdfunding Platforms

Here are some of the leading platforms (as of 2025):

- Fundrise – Great for beginners, low minimums, long-term growth.

- RealtyMogul – Offers both private REITs and individual deals.

- CrowdStreet – Focuses on high-end commercial properties.

- Groundfloor – Short-term, debt-based property loans with high yields.

Before signing up, compare fees, track records, and investment types.

Who Should Consider It?

Real estate crowdfunding is ideal for:

- New investors looking to enter real estate without huge capital.

- Busy professionals who want hands-off, passive investments.

- Experienced investors wanting to diversify outside of stocks or physical rentals.

It’s not for those who need liquidity or guaranteed returns in the short term.

Final Thoughts

Real estate crowdfunding is democratizing access to one of the oldest forms of wealth building. With just a few clicks, you can start investing in property — no landlord duties, no large down payments.

As with any investment, due diligence is key. But with the right strategy and platform, real estate crowdfunding could become a powerful tool in your financial future.